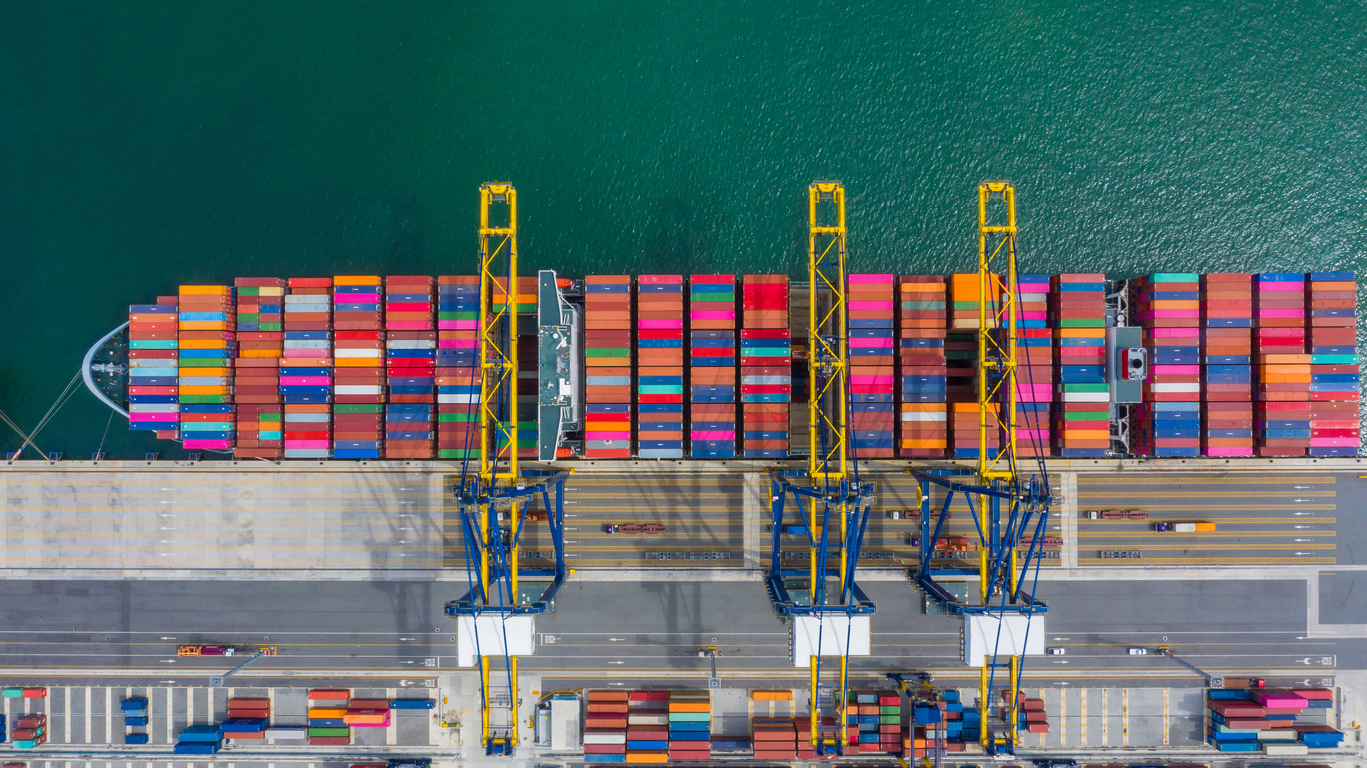

The supply chain industry has been grappling with disruptions ever since the pandemic-induced drop in volumes. Labor contract negotiations, first on the West Coast and now on the East and Gulf Coasts, have added to the ongoing challenges. But labor issues are just one part of the equation. Global disruptions, including those in the Panama Canal, Suez Canal, and the Red Sea, have further complicated the landscape. With import volumes beginning to rise again, the key question remains: will we see a return to pre-pandemic normalcy?

East Coast, Gulf dockworkers to meet next month on strike plan (American Journal of Transportation)

Next month, all eyes will be on the International Longshoremen’s Association (ILA), which represents dockworkers along the East and Gulf Coasts, as they meet with the United States Maritime Alliance (USMA) to negotiate new contracts. Reports suggest the negotiations could be heading toward a labor strike, with the ILA seeking significant wage hikes. Given that six of the ten busiest U.S. ports rely on ILA labor, the outcome of these talks could have far-reaching implications for the entire supply chain. As the September 30 deadline approaches, the industry is bracing for potential disruptions.

‘Near-record surge’ possible for US imports in August: retail group (Journal of Commerce)

After months of volatility following the pandemic, import volumes at U.S. ports are showing signs of stabilization. In August, the retail sector is anticipating a near-record surge in imports, signaling a possible return to normalcy for the industry. As peak season continues, this uptick in volumes could be a strong indicator that the supply chain is beginning to regain its footing.

Flexport data shows sailings from China to U.S. West Coast 20 days faster than to East Coast Ports (American Journal of Transportation)

The lingering effects of the Suez Canal disruptions are still shaping import strategies. Recent data from Flexport, a leading freight forwarder, reveals that sailings from China to the U.S. West Coast are currently 20 days faster than those to East Coast ports. This significant time difference, coupled with the potential for an ILA strike, may drive import volumes toward the West Coast, with goods then being transported across the country via intermodal methods.

June sets record for China-US containers (FreightWaves)

In anticipation of potential service disruptions ahead of the holiday season, importers have been ramping up their shipments. June saw a record-setting month for China-U.S. container volumes, second only to the peaks experienced during the pandemic bottlenecks of late 2020 and 2021. This surge reflects the continued efforts of importers to stay ahead of the curve as the industry navigates through ongoing challenges.

GSC is a leading provider in the shipping logistics industry with over 35 years of experience delivering customized supply chain solutions to world-renowned retailers, manufacturers, and distributors. Interested in how we can help with your drayage and transloading needs? Contact us today or check out our services and solutions here.

Don’t miss out on the latest industry news. Check out our latest Industry Roundups: