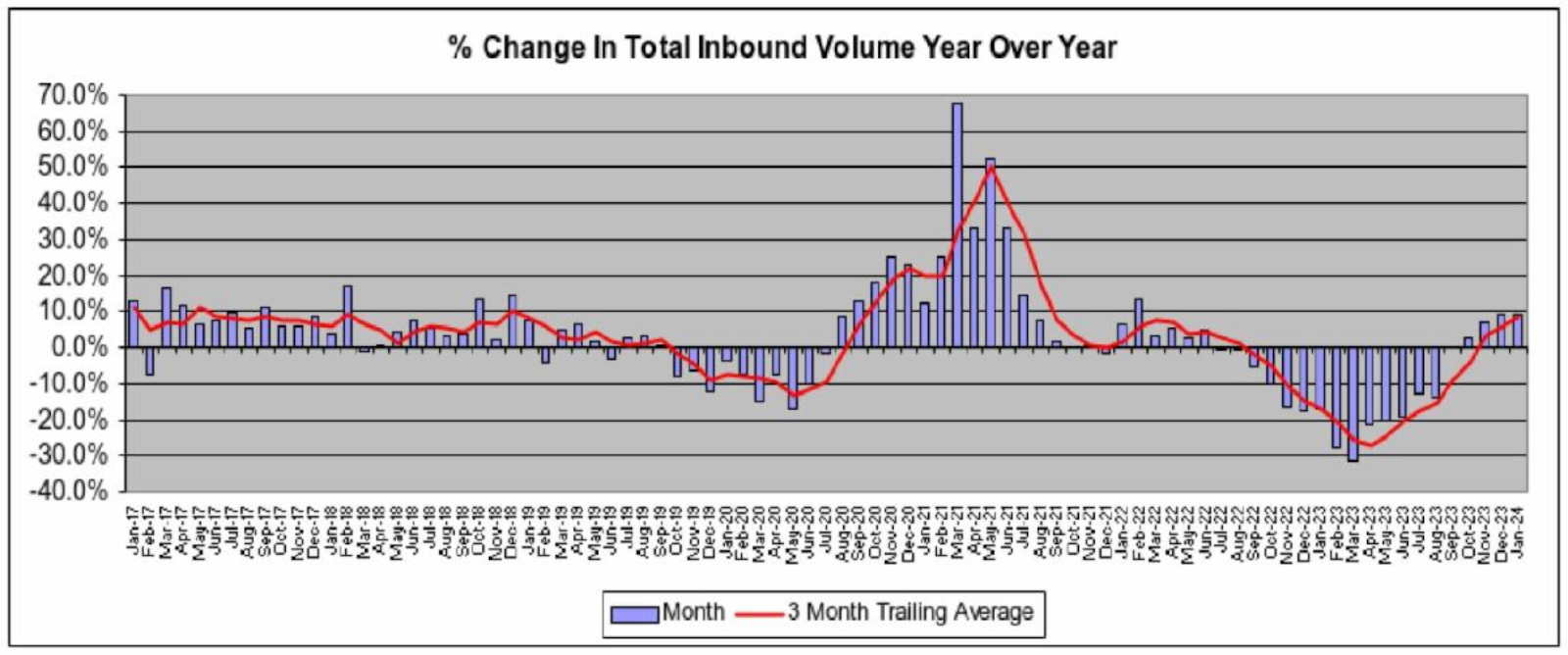

Recent industry news highlights the rise in container volumes, especially along the West Coast. While ports like the Port of Savannah have also seen an increase in cargo, the allocation we saw diverted to the East and Gulf Coasts has largely returned to the West Coast. Additionally, the import data appears not to be influenced by the COVID-19 import surge the supply chain industry experienced and the subsequent inventory surplus, which resulted in a drastic dip in volumes. Container volumes are now returning to reflecting current economic conditions alongside supply chain disruptions.

West Coast Leads Latest surge in U.S. Container Imports (FreightWaves)

The top U.S. ports have seen a year-over-year increase in import volume for the first time in the 15 months following the pandemic import surge. West Coast volumes specifically are up 17.7% when compared with 2023 data.

In addition to rising import volumes, the West Coast is seeing an uptick in volumes due to cargo returning to the West Coast that was once re-routed to the East and Gulf Coasts due to a myriad of supply chain factors on the west coast.

Port Spotlight: Port of Oakland and Ports of Seattle and Tacoma

The Port of Oakland saw a rise in container volumes for the fifth month in a row, yielding a 38.4% increase compared to March 2023. The volumes are the highest the Port of Oakland has seen since August 2022. (Port of Oakland-March Container Volumes)

The Northwest Seaport Alliance (NWSA), home to the Port of Tacoma and the Port of Seattle, saw TEU volumes rise as well, with a 2.9% rise in cargo in the first quarter of 2024. When comparing the data to 2023 numbers, imports have increased by 5.6% and exports grew by 14.8%. While imports increased, specifically Auto volumes were up 9.5%. (NWSA TEU Volumes Up 2.9%)

Import surge boosting rail container dwells at some LA-LB marine terminals (Journal of Commerce)

With the sudden uptick in volumes along the West Coast, the LA / LB ports received the largest uptick in cargo volumes. The influx of cargo returning to the West Coast has caused some dwell time for containers routing from the terminals to the railways to be distributed throughout the country. LA / LB is the top port by volume in the U.S. and with the high volumes occasionally comes some congestion. When selecting the West Coast, there are multiple options that allow BCOs to diversify the cargo routes to minimize disruptions.

Strong consumer spending drives another import upgrade from U.S. retailers (Journal of Commerce)

With the rise in container volumes, we’ve also seen consumer spending increase even with the current inflation and economic conditions. According to the Journal of Commerce, retailers have yet again upgraded import forecasts in the U.S. Reportedly, retail BCOs anticipate monthly volumes above 2 million TEUs well into the 2024 supply chain peak season. The volumes haven’t been forecasted this high for multiple months in nearly two years.

GSC is a leading provider in the shipping logistics industry with over 35 years of experience delivering customized supply chain solutions to world-renowned retailers, manufacturers, and distributors. Interested in how we can help with your drayage and transloading needs? Contact us today or check out GSC’s services and solutions.

Don’t miss out on the latest industry news. Check out our latest Industry Roundups: