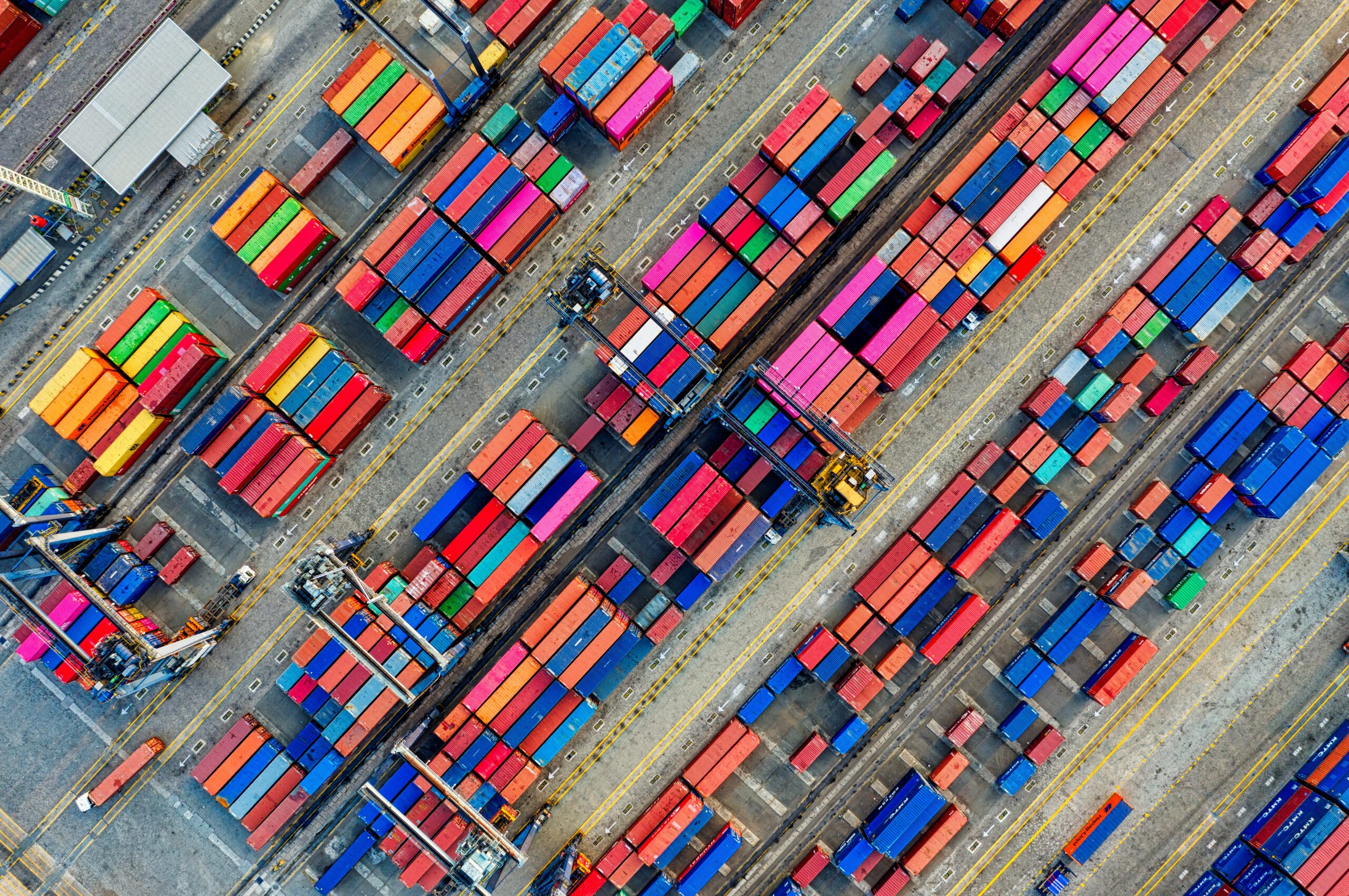

The global supply chain is one of the most dynamic industries marked by its rapid changes. In 2023, the industry faced a series of uncertainties, ranging from the fluctuations in cargo volumes to the shipping disruptions at the Panama Canal and the challenges posed by the ongoing ILA contract negotiations. Amidst these challenges, positive developments are surfacing, from the potential transformation of supply chain protocols through the utilization of digitization information sharing systems and the rebound of container volumes in the West Coast Ports and more.

Here are the latest 5 industry news stories you don’t want to miss:

Biden Administration Announces Massive Logistics Plan

The Biden Administration has announced a massive interagency agenda to tackle issues plaguing the U.S. supply chain. This comprehensive agenda leverages strategies of using both domestic tools and international partnerships to help diversity and strengthen the supply chain. These initiatives include expanding the Department of Transportation’s digital information sharing system, Freight Logistics Optimization Works (FLOW) program. This program aims to reduce inflation by connecting and sharing data across all facets of the supply chain at major trade points to enable a resilient and global competitive freight network. U.S. Secretary of Transportation, Peter Buttigieg, emphasized the program’s significance, “The FLOW data initiative is now helping companies and ports make better data-driven decisions that will ultimately move goods more efficiently and keep costs down for Americans.”

ILA, USMX Remain at Odds Over Dockworker Wage Increases

A potential disruption looms for the U.S. East and Gulf coasts due to ongoing negotiations between maritime employers and the International Longshoremen’s Association (ILA) regarding a new pay raise. The ILA president, Harold Daggett, emphasized the need for a substantial increase in hourly wages for contract workers before addressing other contract terms. Daggett also warned of a potential coastwide strike in 2024 if an agreement is not reached before the current contract expires in September 2024. In addition to seeking higher wages, the ILA is demanding safeguards against full automation at marine terminals and urged ILA members to increase productivity to meet expected container move targets.

West Coast Ports See Rebound in Container Volumes

In October, the West Coast ports experienced significant year-over-year increases in cargo container volumes. The Port of Long Beach reported a 14.7% rise in container volume, from 658,428 TEUs to 755,150 TEUs. The Port of Los Angles recorded a 7% increase to 725,774 TEUs compared with 678,429 TEUs a year ago. Moreover, the Port of Oakland experienced a significant upswing in export container volume, reaching its peak for the year at 68,974 TEUs—a 4% increase compared to October 2022. Additionally, the Northwest Seaport Alliance reported processing 274,626 TEUs at the Ports of Seattle and Tacoma, reflecting a 0.9% increase compared to 2022. Overall, the U.S. West Ports are optimistic about their capacity to handle the rebound in cargo volumes for the upcoming holiday shopping season.

Panama Canal Drought Hits New Crisis Level

Due to the severity of the El Niño-induced drought, the Panama Canal Authority is imposing further restrictions on daily vessels allowed to transit through the Panama Canal. The number of ships allowed to pass through the canal decreased from 29 to 25 in the preceding weeks. This number will continue to be reduced to 18 ships a day by February of 2024. This ongoing backlog crisis will continue to impede global supply chain flow and cause delays in container shipments. To navigate the reduced transit schedule, shippers are exploring alternatives, including moving freight via the Suez Canal and rerouting cargo to U.S. West Coast ports.

Rate Spread Between U.S. East-West Coasts Erodes Amid Shifts in Volume

The recent increase in import volumes at the U.S. West Coast ports reflects a gradual decrease in the spread of ocean freight rates between the East and West Coasts on Southeast Asia imports. From September 1 to November 1, the short-term rate to the East Coast dropped by $691 per forty-foot equivalent unit (FEU), while the rate to the West Coast decreased by only $131 per FEU. Experts suggest that, due to the current backlog at the Panama Canal, shippers will continue to reroute cargo through the Suez Canal, leading to increased volume at West Coast ports and further contributing to the narrowing ocean freight rates between the two coasts.

GSC is a leading provider in the shipping logistics industry with over 35 years of experience delivering customized supply chain solutions to world-renowned retailers, manufacturers, and distributors. Interested in how we can help with your drayage and transloading needs? Contact us today or check out our services and solutions here.

Don’t miss out on the latest industry news: